Such a provision of information removes transaction level reconciliations and facilitates developing continuous auditing. For auditors, this offers the potential for a transition from a periodical or annual exercise to a continuous matter, one that can now encompass both parties to a transaction simultaneously. The authors wish to thank Warren Maroun and the two anonymous reviewers for their insightful and constructive suggestions that helped to strengthen our contribution.

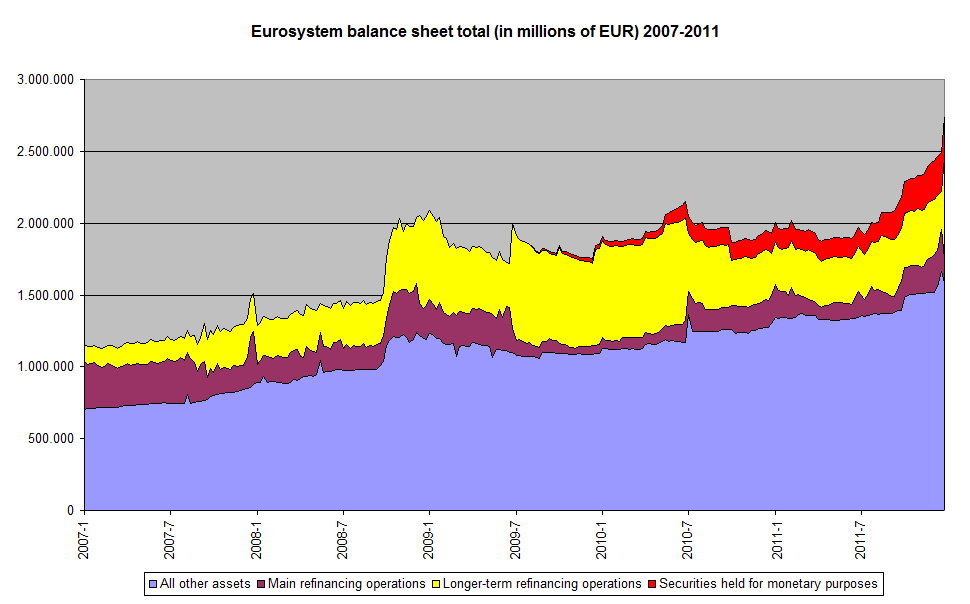

Figure 2.

First, in line with Garanina et al. (2021), Mancini et al. (2021), Lombardi et al. (2021) and Secinaro et al. (2021), the research on blockchain in accounting studies is primarily qualitative. Contrary to other studies, our SLR was updated at the beginning of 2022; therefore, it includes the most recent literature reviews published on the topic. Furthermore, although it is based on a “manual” and qualitative evaluation of each piece of research, it uses the PRISMA protocol and bibliometric software, both of which were extremely useful in supporting the research team in setting up the SRL, in the bibliometric visualizations and in analyzing and discussing each contribution. However, especially in light of other SLRs on similar topics, we see an opportunity to perform future in-depth analyses to test new methods, including empirical and quantitative methods.

The authors are also thankful to Filippo Zatti and the research unit Blockchains and Artificial Intelligence for Business, Economics and Law (BABEL) for their expert insights into the complex topic of blockchain technology. Moreover, our SLR allows us to highlight potential future developments related to the use of blockchain for accounting and, more broadly, blockchain in business studies. Figure 4 (cooccurrence analysis of the authors’ keywords) and, with more details, Figures 5–7 (cooccurrence heatmaps of the authors’ keywords by cluster) confirm the reliability of not only the keywords chosen for the SLR but also the three clusters, which are consistent with the words most used in the analyzed papers. This area is undeveloped because blockchain is a recent technology, and there are few use cases to study (Pimentel and Boulianne, 2020). According to Karajovic et al. (2019), blockchain for accounting information systems will reach a critical adoption mass within the next three years and will become mainstream in 2025. Researchers have worked to build a theory to explain how quick ratio calculator online blockchain will change accounting.

Furthermore, decentralized systems entail governance issues that pose challenges when urgent decisions are needed (Zachariadis et al., 2019). Auditors could extend their services to work as accounting blockchain information systems administrators or advisors (Bonyuet, 2020). Auditing procedures and standards will need to keep pace with the new IT environment (Gauthier and Brender, 2021), as new accounting systems will be subject to control testing (Sheldon, 2019). The purpose of blockchain, namely, to facilitate trust without intermediaries, has raised concerns about the future of auditors and their role in society. However, thus far, these worries are not justified because some aspects of the auditing process still require professional judgment (Turker and Bicer, 2020). Some audit procedures, such as sampling, confirmation letters, payroll examinations, invoice evaluations and reconciliation, will become less expensive or obsolete (Turker and Bicer, 2020).

Tiberius accounting articles and case studies for dummies and Hirth (2019) confirm that auditors’ expectations align with those of academics, who believe that the role of auditors will not be filled by blockchain technology. Ferri et al. (2020) found that performance expectancy and social influence generally lead to blockchain adoption intentions. Kend and Nguyen (2020) found that auditors are skeptical of the usefulness of blockchain for auditing. Dyball and Seethamraju (2021) highlight that auditors consider clients that use blockchain applications as riskier because there is no accounting consensus about how to address their needs. Therefore, the essential benefits perceived by practitioners are unclear but seem to include reductions in time-consuming activities and the need for additional opinions.

Blockchain Technology in Accounting and Auditing: A Comprehensive Analysis and Review of Feasible Applications

- Another possible application is triple-entry bookkeeping, with third entries recorded on a chain (Dai and Vasarhelyi, 2017; Wang and Kogan, 2018), despite certain issues related to confidentiality and transparency that must be addressed and resolved.

- The next section discusses the primary and most impactful contributions on the links between blockchain and accounting and auditing (Section 3.1), finance innovations and the representation of cryptoassets (Section 3.2) and business model innovation and supply chain management (Section 3.3).

- This study also involves a comprehensive analysis of selected 80 studies to determine which year the most studies were published, the research methodologies they used, and the aspects of accounting that were involved.

- New technologies and digital innovations are gradually reshaping the contours of accounting, auditing and reporting (Bonsón and Bednárová, 2019; Dai and Vasarhelyi, 2017; Lombardi and Secundo, 2020; Mancini et al., 2021; Marrone and Hazelton, 2019).

- Today, we are racing toward yet another inflection point that holds tremendous promise and potential for the future of audit.

In the agricultural supply chain, blockchain could increase traceability, auditability, immutability and provenance (Kamble et al., 2020). Parmentola et al. (2022) conclude that blockchain could create a more sustainable supply chain in line with the sustainable development goals. At Deloitte, our people work globally with clients, regulators, and policymakers to understand how blockchain and digital assets are changing the face of business and government today. New ecosystems are developing blockchain-based infrastructure and solutions to create innovative business models and disrupt traditional ones. This is occurring in virtually every industry and in most jurisdictions globally.

Table 4 provides some quantitative data (total citation and CPY) regarding the studies with the highest impact on this topic. Through smart contracts, blockchain offers a new way to collect capital from the public without intermediaries that screen projects and mandatory professional entities that evaluate corporate governance practices before fundraising can begin (Subramanian, 2020). However, in the absence of these forms of investor guarantees (involved intermediaries), Giudici and Adhami (2019) found that fundraising success depends on a project’s team and the advisory committee’s reputational capital at stake. According to Gan et al. (2021), the critical success factors in this context are the existence of a liquid secondary market, a minimum price-cost ratio of 2, a critical mass condition and the establishment of a maximum number of tokens.

Report an issue or find answers to frequently asked questions

Although the popularity of blockchain is usually linked to its status as the foundation of Bitcoin and other cryptoassets (Buterin, 2014; Nakamoto, 2008), public and institutional attention is now extending to the technology itself and its potentially disruptive applications unrelated to digital currencies. Blockchain technology (BT) has been receiving increasing attention from the academics and practitioners, in terms of its emergence, evolution, transformation, potential disruptions, technical aspects, and implications on accounting, auditing and finance practices. Through a review of the 51 papers published from 2015 to 2021 in Scopus indexed academic journals in accounting and auditing. Based on the analysis of the selected papers, this chapter charts the current knowledge on BT, examines key themes identified from the literature, and recommends opportunities for future research. The chapter finds that the innovation and ensuing disruption of BT is still in an emerging phase, particularly the scope and influence in the accounting, auditing, and finance practice and research. The findings of this chapter can be used by the key stakeholders involved in professional practice in the accounting and auditing domain.

Blockchain and the Future of Accountancy: A Review on Policies and Regulations

Today, we are racing toward yet another inflection point that holds tremendous promise and potential for the future of audit. (2020), “Challenges when auditing cryptocurrencies”, Current Issues in Auditing, Vol. (2019), “NFTs in practice – non-fungible tokens as core component of a blockchain-based event ticketing application”, Paper presented at the 40th International Conference on Information Systems, ICIS 2019. If buying and selling cryptocurrencies was part of the ordinary business of an entity, then it would be possible to account for cryptocurrencies as inventory. 9 states, “Inventories shall be measured at the lower of cost and net realizable value,” and if a company is a broker-trader, then it can value cryptos at fair value less cost to sell (Procházka, 2018; Morozova et al., 2020).

A systematic review and research agenda from the perspective of sustainable development goals (SDGs)”, Business Strategy and the Environment, (August), Vol. (2017), “Toward blockchain-based accounting and cash book excel assurance”, Journal of Information Systems, Vol. Finally, because cryptos fulfill the asset definition but are not tangible or a type of asset included within the scope of principles other than IAS38, they can be considered intangible assets. Thus, cryptos fall under the accounting rules for “Intangible assets with indefinite useful lives” (IAS 38.107), so they cannot be amortized but only impaired.